On March 6th, 2025, the State Taxation Administration of China issued Announcement No.6 of 2025, stating that the "Agreement between the Government of the People's Republic of China and the Government of the Italian Republic for the Elimination of Double Taxation and the Prevention of Tax Evasion with Respect to Taxes on Income" (hereinafter referred to as the "Agreement" or "DTA") entered into force on February 19th, 2025.

The Agreement applies to taxes withheld at source on incomes obtained on or after January 1st, 2026.

Core Benefits: Eliminate double taxation, reduce tax burden on cross-border investment, and enhance tax certainty.

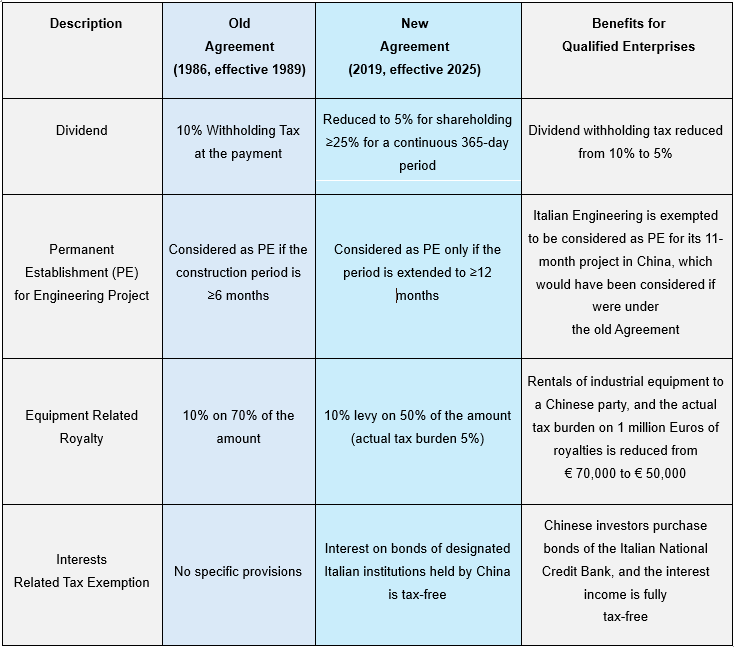

1. Comparison of Selected Key Changes Between Old and New Agreements (with examples)

Note: The above list is for illustrative purpose only and is not complete, feel free to refer to contact our professionals for any questions you may have

2. Three Core Benefits for Italian Enterprises (with examples)

1) Increased Equity Investment Returns

For Italian investors holding more than 25% of shares for one year, the withholding tax levied in China and applicable to dividend distributions is reduced by 50% (from 10% to 5%).

Example: The annual profit of the Chinese subsidiary of an Italian luxury goods group is 10 million Euros; under the new DTA, the dividends' distribution benefits of € 500,000 instead of € 1,000,000 taxation.

2) Zero Tax Cost for Short-Term Projects

Construction/installation projects do not constitute a permanent establishment within 12 months.

Example: A Milan engineering design company undertakes an 11-month landmark project in Shanghai and is now exempt from Corporate Income Tax in China in relation to the project (and the profits) here located.

3) Optimized Tax Burden for Technology Export

The actual withholding tax rate for industrial equipment royalties is only 5% (10% of the 70% of the amount under the old Agreement).

Example: Italian robot manufacturer Company authorizes a Chinese factory to use its patents, for 1 million Euros in license fees, when applying this provision payments derived from the use, or the right to use, of industrial, commercial or scientific equipment shall be taxed on the basis of 70% of the gross amount of royalties, instead of the original € 70,000, under the new DTA, taxation is reduced to € 50,000.

In summary, from the halving of dividend withholding tax rate (when shareholding conditions are met) to the tax exemption for short-term projects brought about by the extension of the recognition time for engineering permanent establishments, and then to the reduction of the actual tax rate of equipment royalties to 5%, the new tax agreement has accurately reduced the tax burden on key links of Italian enterprises' operations in China.

Combined with China's continuously relaxed foreign investment access policies, and various incentive measures provided by local Governments, Italian investors are facing unprecedented strategic opportunities for investment in China.

At PHC Advisory, we can offer you full support on matters regarding doing business in China, or any other issues your business may face. If you would like to know more about policies relevant to your business in Italy or Asia, please contact us at info@phcadvisory.com.

PHC Advisory is a company of DP Group: an international professional services conglomerate of companies with approximately 100 experienced professionals worldwide. We offer comprehensive services in tax, accounting, and financial consulting, including financial supervision, financial audit, internal audit, internal control over financial reporting, and support for audited financial statements and annual audits, ensuring clients' financial transparency and compliance.

Would you like to learn more about the business environment in China? Click the link and download our Practical Guides on Amazon!

The content of this article is provided for informational purposes only, financial advice must be tailored to the specific circumstances on a case-by-case basis, and the contents of this article do not legally bind PHC Advisory with the reader in any way.