The main news regarding IRPEF (Personal Income Tax) for employed workers in Italy in 2025 are the stabilization of the three-tier tax rate and income bracket structure introduced in 2024 and the confirmation of the tax wedge reduction.

Here's a detailed summary:

1. Stabilization of IRPEF Rates and Brackets:

For 2025, the following tax rates and income brackets remain in effect:

23% for income up to €28,000.

35% for income exceeding €28,000 and up to €50,000.

43% for income over €50,000.

2. Tax Reduction:

Measures to reduce the tax burden on employed workers with income up to €40,000 are confirmed, through two mechanisms:

Allowance (exempt from IRPEF and contributions) for income up to €20,000:

7.1% for income up to €8,500.

5.3% for income exceeding €8,500 and up to €15,000.

4.8% for income exceeding €15,000 and up to €20,000.

The maximum amount of this allowance is approximately €1,000 per year, paid monthly in the payslip.

Additional tax deduction for income exceeding €20,000 and up to €40,000:

For income between €20,001 and €32,000: a fixed deduction of €1,000 per year, to be prorated based on the working period.

For income between €32,001

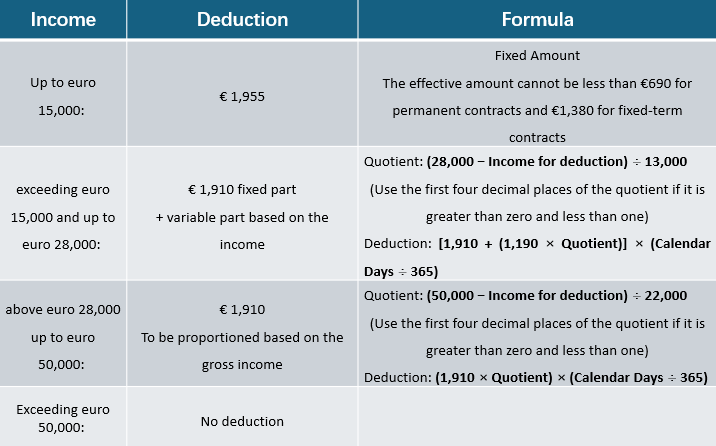

The deductions for employees are confirmed and made structural, to be prorated based on the number of days of employed work:

The deduction is increased by €65 if the total income is greater than €25,000 but not more than €35,000.

Example of 2025 IRPEF Calculation

(Gross Annual Income €35,000)

Gross Tax:

1. 23% on € 28,000:

€28,000 × 0.23 = €6,440

2. 35% on the excess of the previous bracket:

(€35,000 - €28,000) × 0.35 = €7,000 × 0.35 = €2,450

3. Total Gross Tax:

€6,440 + €2,450 =€8.890

Calculation of Deduction for Employed Work:

1. Income between €28,001 and €50,000:

First, calculate the quotient, considering the first four decimal places.

Quotient = (50,000 − 35,000) ÷ 22,000 = 15,000 ÷ 22,000 = 0.6818

2. The deduction is determined based on the quotient obtained and the applicable increase:

Base annual deduction = €1,910 × 0.6818 = €1,302.24

3. Increase for income between €25,000 and €35,000 equal to €65

4. Total Annual Deduction (assuming 365 working days) €1,302.24 + €65 =€1,367.24

Net Tax: €8,890 - €1,367.24 = €7,522.76

For the instructions on filling out the forms, here is the link to the Agenzia delle Entrate (Italian Revenue Agency) portal.

Remark: Please note that this is a simplified example and does not include any other deductions or deductible expenses that the taxpayer may be entitled to (e.g., dependent family members, medical expenses, mortgage interest, building renovations, etc.).

Comparison with China's Individual Income Tax (IIT) System

Interesting the comparison with the Individual Income Tax (IIT) in China, which is a tax levied on the earnings of individuals, including both Chinese nationals and foreign residents, who reside in China or derive income from within the country. The IIT system in China operates on a progressive tax structure with rates ranging from 3% to 45%, depending on the income level.

Here's a breakdown of key aspects of China's IIT system:

1. Key Elements of the IIT

(1) Taxpayers and Tax Residency:

Resident Taxpayers: Individuals who are domiciled in China or have resided in China for an aggregate of 183 days or more within a tax year (January 1 to December 31) are considered resident taxpayers. They are taxed on their worldwide income.

Non-Resident Taxpayers: Individuals who are not domiciled in China and reside for less than 183 days in a tax year are considered non-resident taxpayers. They are taxed only on income derived from sources within China.

Non-China-Domiciled Residents: Foreign individuals who reside in China for 183 days or more but for less than six consecutive tax years may be exempt from IIT on their foreign-sourced income (after filing with tax authorities).

(2) Taxable Income Categories:

China's IIT law groups personal income into nine categories. For resident individuals, some of these are combined as "comprehensive income" for annual tax calculation:

Comprehensive Income (taxed annually):

Salaries and wages

Remuneration for labor services

Author's remuneration

Royalties

Other Income (taxed monthly or per transaction):

Income from business operations (self-employed individuals)

Income from interest, dividends, and bonuses

Income from the lease of property

Income from the transfer of property

Incidental income

2. Tax Rates:

(1) Comprehensive Income: Subject to a seven-level progressive tax rate ranging from 3% to 45% based on annual taxable income.

(2) Income from Business Operations: Subject to a five-level progressive tax rate ranging from 5% to 35% based on annual taxable income.

(3) Other Income (e.g., interest, dividends, propertytransfer): Generally taxed at a flat rate of 20%. However,dividends, interest, royalties, and rental income received by non-residentforeign nationals from China sources are often subject to a 10% withholding tax under double tax treaties.

(4) Deductions: Taxable income is calculated after deducting certain allowances and expenses:

Standard Deduction:

For resident taxpayers: RMB 60,000 per year (RMB 5,000 per month).

For non-resident taxpayers: RMB 5,000 per month.

Special Deductions: Include social insurance premiums and housing fund contributions (amounts vary regionally).

Special Additional Deductions: Include expenses for childcare, education, healthcare, housing loan interest, and elderly support. These deductions have specific regulations and limits.

Other Deductions: Certain types of income may have specific deductions (e.g., rental income can deduct RMB 800 or 20% of income, whichever is higher).

3. IIT Calculation and Filing:

Resident Individuals: IIT on comprehensive income is calculated using a cumulative withholding method, with employers required to withhold and report IIT monthly. An annual reconciliation is required between March 1 and June 30 of the following year if certain income thresholds are met or if a tax refund or additional payment is needed.

Non-Resident Individuals: IIT is typically calculated and withheld monthly or per transaction on their China-sourced income.

Self-Employed Individuals: Must file IIT quarterly and handle final reconciliation by March 31 of the following year.

4. Annual Reconciliation:

Resident taxpayers may need to file an annual IIT reconciliation to:

Settle any overpaid or underpaid taxes on their comprehensive income.

Claim any eligible deductions not fully accounted for during monthly withholding.

Report comprehensive income exceeding RMB 120,000 where the final tax repayment exceeds RMB 400.

Apply for a tax refund if the tax withheld exceeds the actual tax liability.

The annual IIT reconciliation period is typically from March 1st to June 30th of the following year. For the 2024 tax year (filing in 2025), there are specific periods and appointment requirements for early filers (March 1-20).

5. Special Considerations for Foreigners:

Tax Treaties: China has Double Taxation Agreements (DTAs) with many countries, which may provide tax relief or specify tax rules for residents of those countries working in China.

Exemption Based on Stay: Non-domiciled individuals may be exempt from IIT on foreign-sourced income under certain conditions related to their length of stay in China.

Deductions: Foreigners may be able to claim specific deductions for housing, education of children, and home leave travel, subject to certain conditions and documentation requirements.

It's crucial for individuals working in China, both Chinese and foreign nationals, to understand their tax residency status and comply with the IIT regulations, including monthly withholding and annual reconciliation where applicable. Employers also have responsibilities for accurately calculating and withholding IIT from their employees' salaries.

At PHC Advisory, we can offer you full support on matters regarding doing business in China, or any other issues your business may face. If you would like to know more about policies relevant to your business in Italy or Asia, please contact us at info@phcadvisory.com.

PHC Advisory is a company of DP Group: an international professional services conglomerate of companies with approximately 100 experienced professionals worldwide. We offer comprehensive services in tax, accounting, and financial consulting, including financial supervision, financial audit, internal audit, internal control over financial reporting, and support for audited financial statements and annual audits, ensuring clients' financial transparency and compliance.

Would you like to learn more about the business environment in China? Click the link and download our Practical Guides on Amazon!

The content of this article is provided for informational purposes only, financial advice must be tailored to the specific circumstances on a case-by-case basis, and the contents of this article do not legally bind PHC Advisory with the reader in any way.