In the People’s Republic of China (“PRC” and “China”), both individuals and corporate taxpayers (hereinafter referred as “Taxpayers”) are periodically required to meet relevant tax payment obligations. The “Law of the People’s Republic of China on the Administration of Tax Collection” (“ATC Law”) provides the main rules for the collection and payment of taxes, as well as the consequences in case of failure to comply, while safeguarding the legitimate rights and interests of taxpayers.

This article provides an overview of the main implications in the circumstances of taxpayers’ failure to comply with the relevant PRC tax laws and regulations.

From a general standpoint, the PRC tax authority shall be entitled to conduct tax inspections on taxpayer’s accounting books, commodities and certifying documents pertaining to the payment of taxes, in order to determine the correct and timely registration and payment of relevant taxes.

Should the competent tax authority find irregularities in the correct maintenance of the taxpayer’s accounting books, with regard to the compliance to the formalities for tax administration regulation, the tax authority shall order the taxpayer to make rectification within a given time limit and, in some cases, impose a fine. Moreover, should the tax authority find irregularities with the tax calculation basis declared by the taxpayer – and where the tax calculation basis declared by the taxpayer is significantly low without any justified reasons, the tax authorities have the right to assess the amount of tax payable based on certain criteria specified under the State Council.

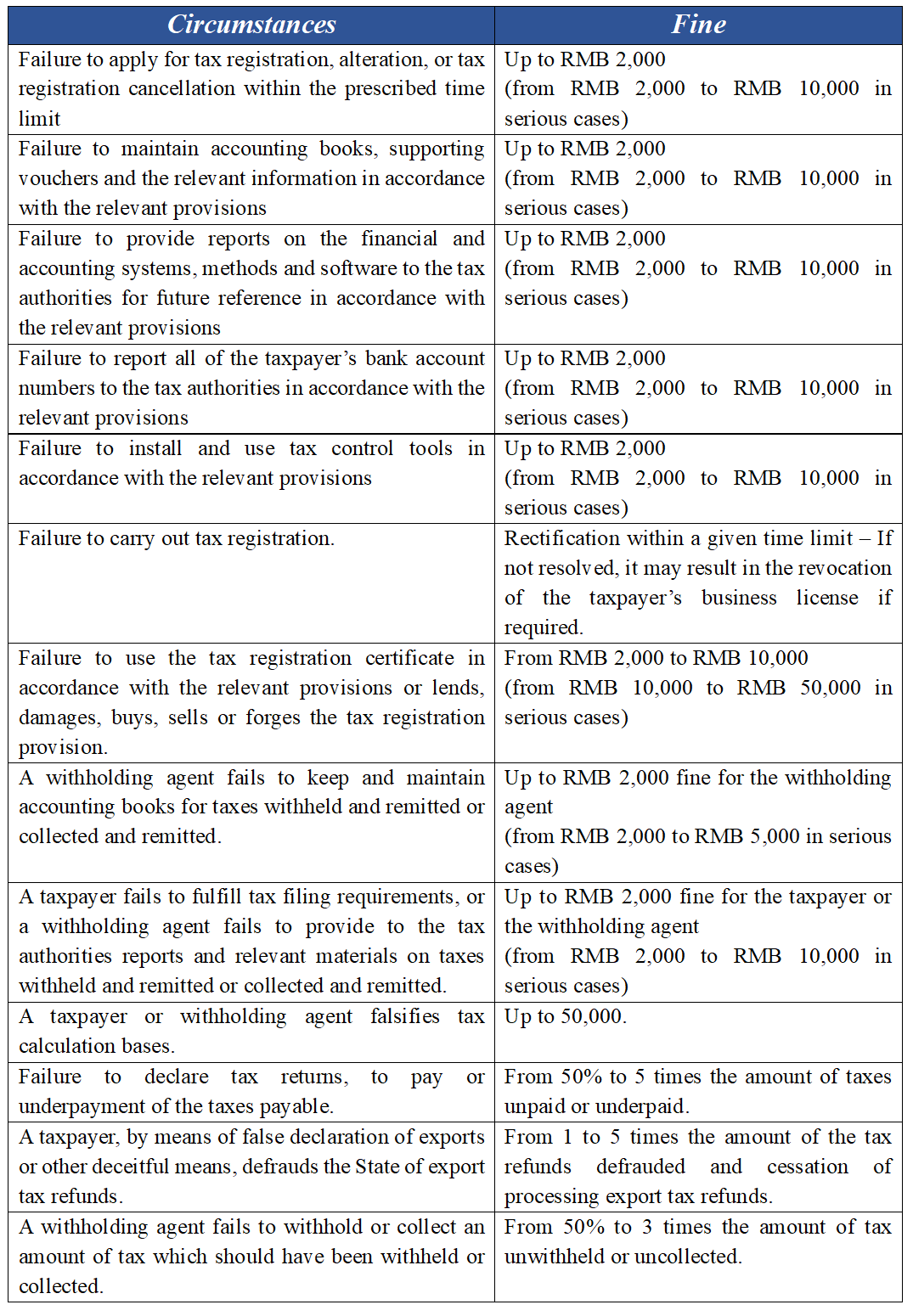

We have provided a general overview of the main fines applied in certain circumstances provided under the ATC Law below:

In the event of failure to pay taxes within the prescribed time limit, the competent tax authorities shall require the taxpayer to pay the amount of taxes underpaid or unpaid – within a fixed period of time, and impose a fine on a daily basis rate of 0.05% (which corresponds to an annual interest rate of over 18.25%), starting from the date of the failure to payment.

In the case of failure to pay taxes within the fixed period of time, the tax authorities may take mandatory enforcement measures consisting of:

1. Notifying the taxpayer’s banks to withhold and remit the amount of tax in their deposits;

2. Impound, seal off or sell by auction or sell the commodities, goods or other property of the taxpayer – the value of which shall be equivalent to the amount of tax payable – and use the gains to compensate for the amount of tax payable.

Such measures shall not include housing and necessities essential for the daily living of individuals and their dependents.

In the event that a taxpayer fails to pay taxes or underpays taxes due to miscalculations, the tax authorities may, within three years (in special circumstances, the limit may be extended to five years), pursue the payment of the tax amount and late payment fines. However, in the case in which the tax authorities are liable for the taxpayer’s failure to pay taxes or underpay taxes, no late payment fine shall be imposed.

In addition, if the miscalculation of the tax payables results in an excess payment by the taxpayer, the tax authorities shall immediately refund the excess amount to the taxpayer. The claim for refund can be exercised within three years from the date the tax payment was made.

Pursuant to the ATC Law provisions, illegal actions taken with the intent to avoid tax obligations can be referred to as tax evasion actions. These include forging, altering, or destroying accounting books, overestimation of expenses, and omitting or underestimating incomes. Thereon, for taxpayers who evade taxes, the tax authorities may require the taxpayer to pay the amount of tax unpaid together with the late payment fine. In addition, the taxpayer shall be subject to a penalty fine amounting to between 50% and five times the tax amount. In the case of tax evasion, refusal or fraud, the tax authorities shall not be restricted by time limits to pursue the payment of any taxes unpaid or underpaid, late payment fines or tax amount defrauded. Also, where the authorities have grounds to believe a taxpayer has evaded taxes, the taxpayer may be ordered to provide a guarantee for the tax payment, if such guarantee is not produced, the taxpayer’s bank deposits could be frozen – as well as the taxable commodities, goods or other property could be impound and sold – in an amount equivalent to the amount of tax payable.

Moreover, in cases where the taxpayer’s behaviour constitutes a crime, the taxpayer shall be investigated for criminal responsibility in accordance with the relevant PRC laws and regulations.

It shall be stressed that, in case a defaulting taxpayer or his legal representative needs to leave China, unless they settle the amount of tax payable or late payment fines, the tax authorities may take actions to prevent the taxpayer from leaving the Country.

From a broad perspective, in addition to the specific provisions in the ATC Law, it shall be noted that any commercial arrangement that has the impact of reducing, deferring or avoiding taxable revenue (or income) must have a bona fide business purpose in order to be compliant to Chinese General Anti Avoidance Rules (GAAR). In the absence of such purpose, the competent tax authorities have the power to disregard the arrangement and impose adjustments as the case may be. GAAR provisions are contained both under Individual and Enterprise Income Tax Laws – hence, they apply to individual as well as corporate taxpayers.

In everyday practice, taxpayers frequently face difficulties to liquidate and correctly determine the amount of taxes payable, as they may be less familiar with the specific provisions of Chinese tax laws and regulations, as well as the fiscal system and relevant procedures.

At PHC Advisory we are always updated on new tax policies and the most recent developments concerning Asian countries. Send us an email at info@phcadvisory.com to know more about our services that may suit you and your company.